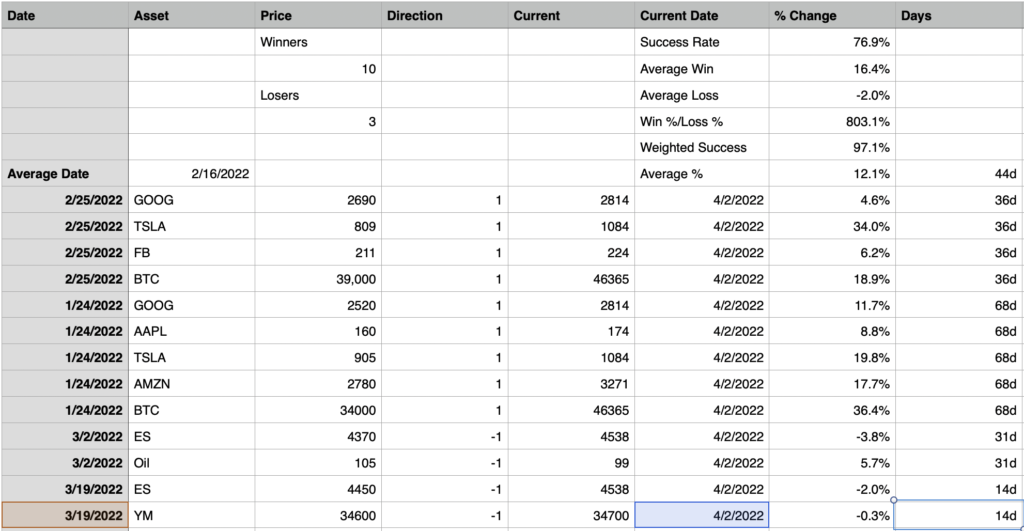

I wanted to highlight the performance of my trading calls I have posted on my website in Q1 2022. I made a total of 13 trading calls. The maximum loss was -3.8% and the maximum gain was 36.4%. 3 trading calls were losers at average loss of 2%. 10 trading calls were winners at average win of 16.4%. The average holding period was 44 calendar days and average performance was 12.1%. The performance of the Nasdaq 100 during the same period was -10%. I beat the market massively. All my trading calls were on highly liquid assets that had a market cap of minimum $100 billion and minimum daily turnover of $1 billion. The minimum executable size for each trading call was $50M. Some trading calls had executable size in excess of $10B. The average annualized unleveraged return per trading call was 157% a year. These stats put me in the top .01% of traders. I wanted to note my trading calls in Q1 2022 constitute 97.1%+ weighted success. The probability of holding such a high weighted success rate over 13 calls is less than 1 in 10,000 quadrillion. Roughly the equivalent of winning the lottery jackpot 2 times in a row. Before I was put in jail for 413 days starting on October 20 2020, I posted a 3 month track record also showing 95%+ weighted success.

By the way, I confronted Justin Le Blanc(Bill Gates’s agent) with these statistics. He kept on insisting that I was a very bad trade caller, sick, false Jesus, very weak at math and always wrong. He kept on focusing on my losing trading calls and ignoring my winning trading calls. This was characteristic of a fool. Anyways, once I showed him these statistics he said he will contact my parents and police about harassing emails. By the way I should note that Google, Microsoft, Amazon, Facebook, NSA all keep daily archives of my website. So I indeed did make these calls and they can see I didn’t make any changes.