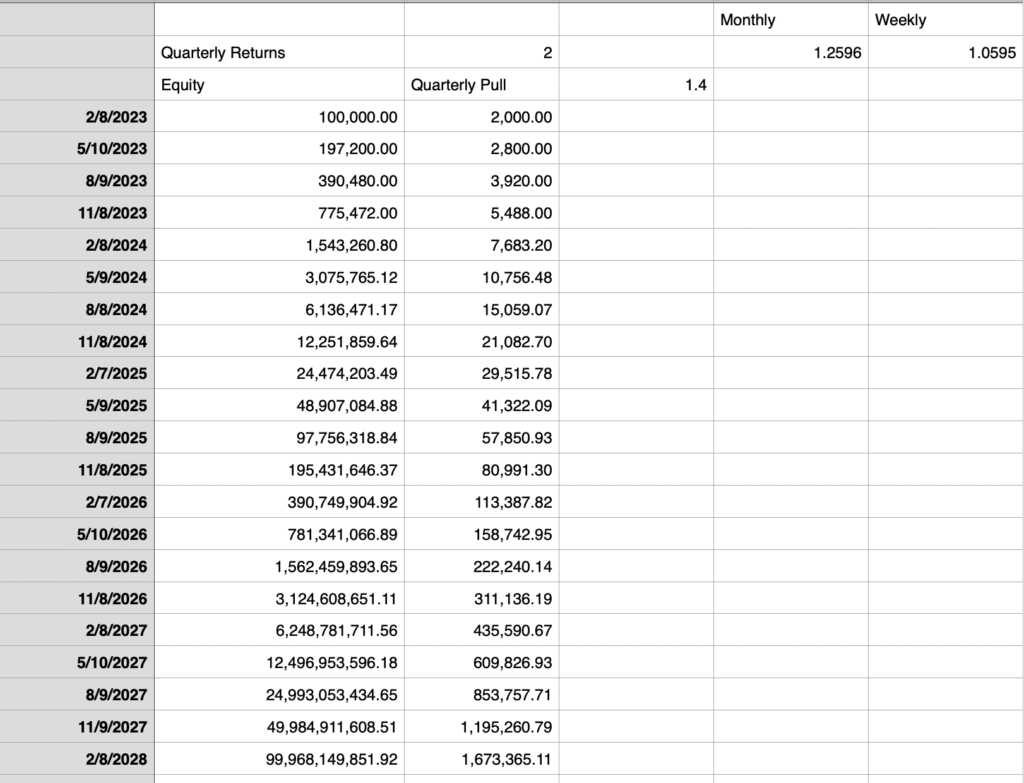

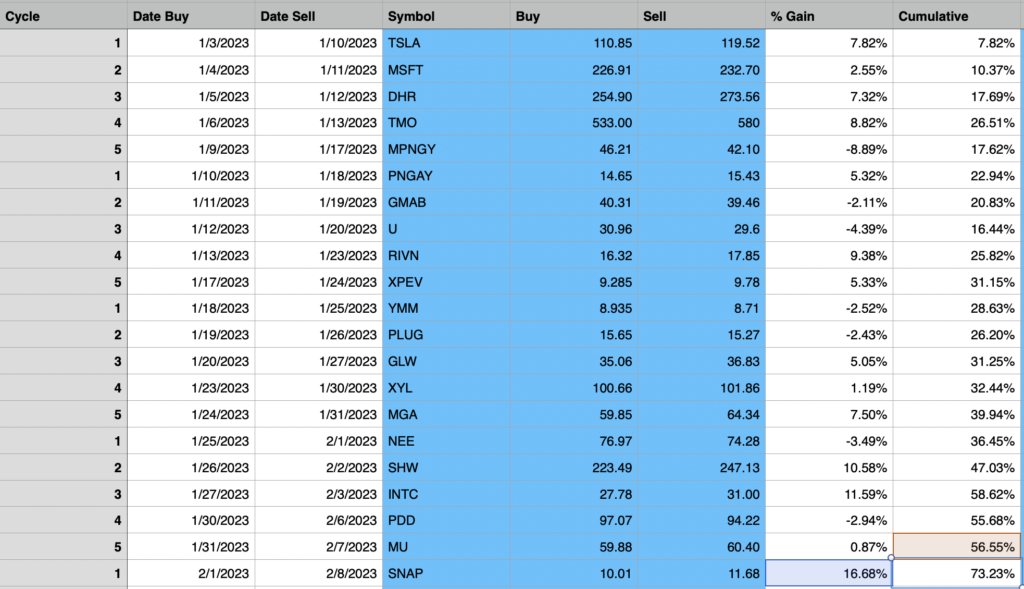

The key to this strategy is buying blue chips during a selling climax or shake-out. This happens when retailers(weak holders) sell shares in a panic fashion to professional money(strong holders). The supply is absorbed by professional money through buying weakness. You would position .4X fold for each position and hold for five trading days. For a $100,000 account that means 5 positions $40,000 each for a total $200,000 exposure. The goal is to double every quarter on 2X leverage, 1500% annualized ROI.

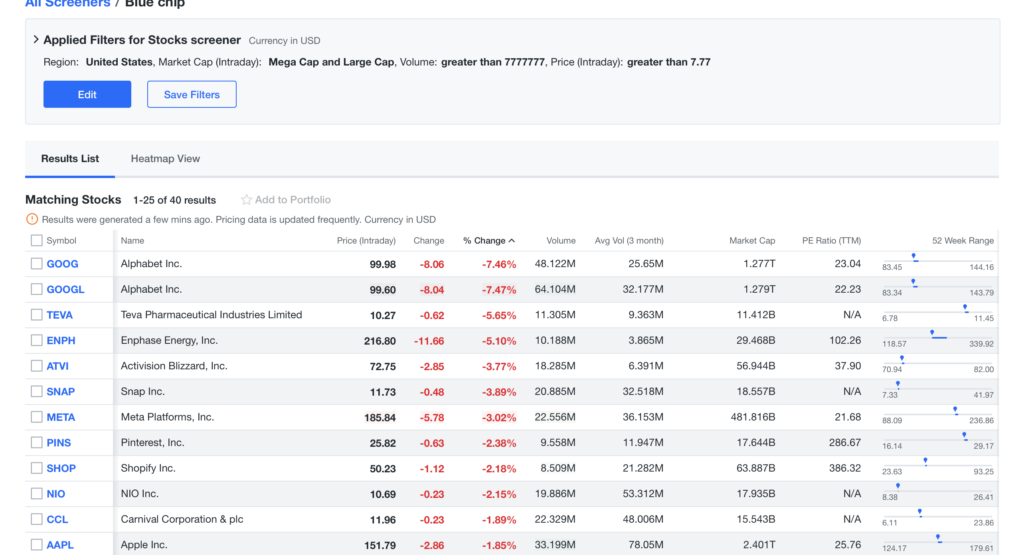

Criteria for scan:

- $7.77 minimum share price

- 7,777,777 minimum trading volume

- Minimum $10B market cap

2 hours after NYSE open buy the stock that moves down the most with these 3 criteria.

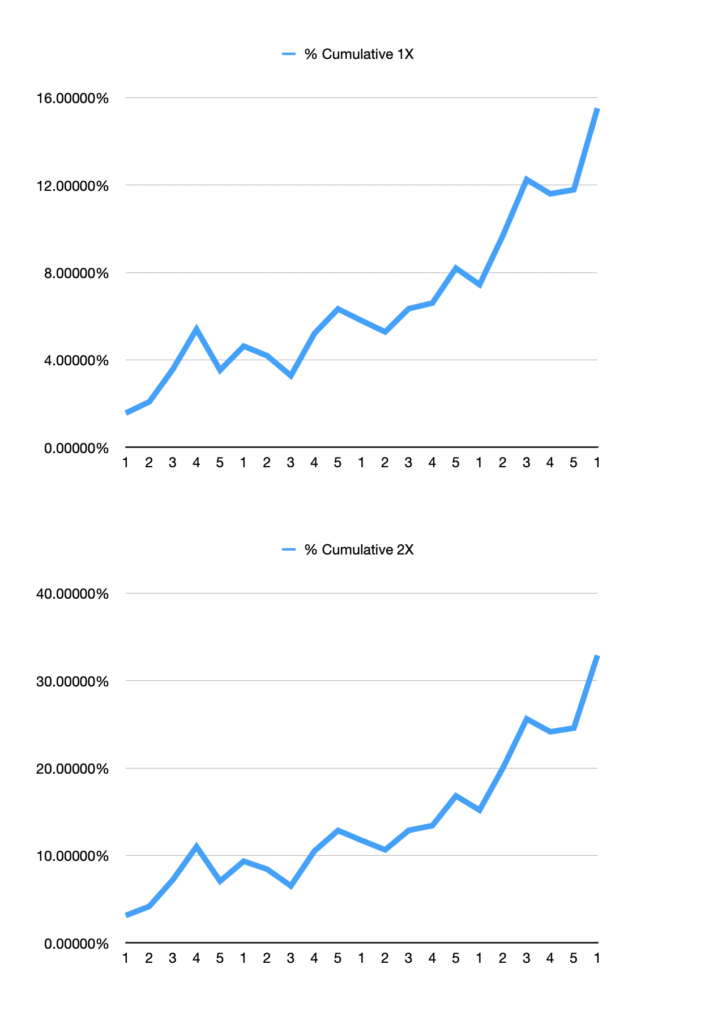

First 20 trading days performance on 1X and 2X leverage